Where gambling is concerned, especially in casinos or online, excitement awaits any player. Still, with a decent strategy for placing the bets, the excitement becomes even more titillating. The Kelly Criterion offers a mathematical way to make your bets profitably big yet loss-minimally small so that the gambler can reap profits with as little loss as possible. However, what is the functionality of it and what are the reasons to take it into account? Let’s get started.

Definition of the Kelly Criterion

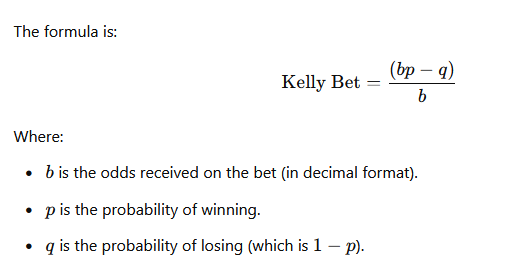

The Kelly Criterion is a mathematical equation that assists in calculating the appropriate bet size considering your perceived advantage and the odds available. Created by John L. Kelly Jr. in 1956, this is an uncommon strategy utilized in both finance and gambling for long-term growth.

This equation provides guidance on how much of your bankroll to wager depending on your advantage: the greater your advantage, the higher the bet; the weaker your advantage, the lower the bet.

Example of the Kelly Criterion

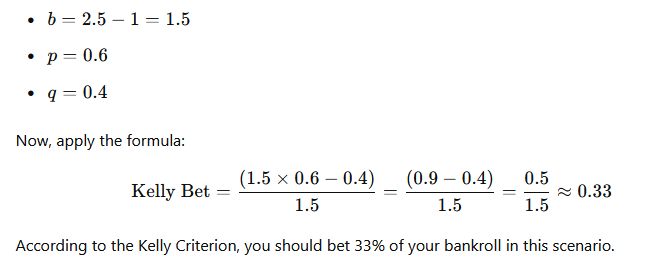

If you bet on a sports match and think there is a 60% chance of your team winning with odds of 2.5 from the bookmaker.

Why the Kelly Criterion?

The Kelly Criterion is well-liked for its focus on increasing long-term growth while controlling risk. In contrast to flat betting or progressive strategies, the Kelly Criterion changes according to your advantage, reducing losses in losing sequences and increasing profits in winning sequences.

One of the main advantages is that it assists in avoiding excessive betting. Overbetting, regardless of your confidence level, can easily exhaust your bankroll if you encounter a series of losses. The Kelly Criterion offers a well-rounded strategy for betting, preventing both excessive and insufficient bets.

Full Kelly vs. Fractional Kelly

While mathematically perfect, the Kelly Criterion gives rather large fluctuations in bankroll when on a losing streak. Most punters use a fractional Kelly strategy to reduce volatility, meaning you only bet along a fraction of what the Kelly Criterion suggests.

You would bet only 15%; for instance, if the Kelly Criterion yielded 30%, that was the suggested amount. With this method, you are better protected from great bankroll swings, which would take a lot of time to grow back while still allowing long-term growth.

The Kelly Criterion and Casino Gaming

The Kelly Criterion can be applied to sports betting, horse racing, and various games such as blackjack, where estimates may be made on the player’s edge. Personally, I always use it to play live blackjack at Quatro Casino. More often than not, it saves my day (along with my bankroll).

This should never be applied to purely gambled games in casinos like slots or roulette, where the house always has a mathematical edge, and no calculable edge can favor the player.

Drawbacks of the Kelly Criterion

While mathematically perfect, the Kelly Criterion is not flawless. The main reason for this is the probable estimation error in the estimate of the winning probability.

If one thinks his or her edge is larger than it is, he or she will end up overbetting and may quickly find themselves out of bankroll. Another assumption of the Kelly Criterion is that one has a very large bankroll and isn’t concerned with minimum or maximum bet sizes, which is a real-world limitation since casinos or sportsbooks do impose limits on bets.

Is the Kelly Criterion Right for You?

The Kelly Criterion is ideal for the more experienced gambler seeking long-term growth and having a relatively good idea of his probability. If one is a beginner or just a little more conservative, it may probably be best to consider a fractional Kelly strategy or flat betting system until you’re comfortable with the potential ups and downs in your bankroll.

Conclusion

The Kelly Criterion offers a mathematically logical way of betting, with a balanced compromise between risk and return. Due to its non-perfect nature at actual implementation and other attendant volatility problems, the Kelly Criterion remains one of the most respected strategies for managing the size of one’s bets to maximize long-term growth. Used wisely, it provides a sound foundation for the serious gambler and the casual bettor looking for an enhanced experience.